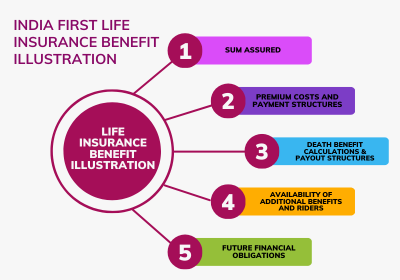

Understanding your India First Life Insurance Benefit Illustration is crucial for making informed decisions about your life insurance coverage. This document provides valuable insights into your policy details, benefits, and future projections. Empowering you to assess its suitability and compare it with other options.

Comparing Different Plans:

The India First Life Insurance Benefit Illustration serves as a powerful tool for comparing different life insurance plans. Here’s how you can leverage it effectively:

-

Sum Assured: Analyze the sum assured offered by various plans. This represents the death benefit payout your beneficiaries will receive. Compare this amount against your financial obligations and future needs to ensure adequate coverage.

-

Premium Costs and Payment Structures: Check the premium costs associated with each plan and their respective payment structures. Consider factors like affordability, payment frequency (monthly, annually), and potential changes in premiums over time.

-

Death Benefit Calculations and Payout Structures: Understand how the death benefit is calculated in different plans. This might involve factors like age at death, policy term, and additional riders. Compare the payout structures to determine how the benefit will be distributed to your beneficiaries (lump sum, installments, etc.).

-

Availability of Additional Benefits and Riders: Explore the more benefits and riders offered by various plans. These might include features like accidental death benefit, waiver of premium rider, or disability income benefit. Compare the availability and costs of these riders to customize your coverage based on your specific needs.

India First Life Insurance Benefit Illustration infographic

Evaluating Coverage Adequacy:

Your India First Life Insurance Benefit Illustration helps you assess if your current coverage meets your evolving needs. Here’s how:

-

Project future financial obligations: Consider your future financial needs, such as outstanding debts, dependents’ education, and desired retirement lifestyle.

-

Analyze projected benefit payout: Compare the projected death benefit payout in your illustration against your anticipated future needs. Identify any potential gaps in coverage.

-

Factor in life changes: Consider potential life changes that might impact your financial needs, such as marriage, children, or career advancement. Re-evaluate your coverage accordingly.

Addressing Questions and Concerns:

It’s natural to have questions about your India First Life Insurance Benefit Illustration. Here are some common concerns and how to address them:

-

Understanding complex terminology: Don’t hesitate to clarify any unfamiliar terms or concepts within the illustration. Contact India First Life customer service or consult a financial advisor for help.

-

Accuracy of information: If you suspect any discrepancies or errors in the information presented, reach out to India First Life for verification and potential corrections.

-

Customizing your coverage: If your needs have changed, explore options for adjusting your coverage through premium changes, adding riders, or converting your policy. Discuss these possibilities with a qualified financial advisor.

Conclusion:

By effectively utilizing your India First Life Insurance Benefit Illustration. You gain valuable insights into your coverage, enabling informed decision-making. Remember, this document serves as a starting point, and seeking professional guidance from a financial advisor can further empower you to choose the right life insurance plan that aligns with your evolving needs and financial goals.

Pingback: Sun Life Insurance Company Limited: A Trusted Partner for Your Future